Circularity

Introduction

Sustainability requires a holistic and integrated approach that considers the complexities or convolutions of the full supply chain and encourages a shift away from short-term, reactionary practices toward long-term thinking and responsible decision-making. Achieving sustainability often involves making informed and sometimes difficult choices that balance the needs of the present with the current and future impacts over the full lifecycle of electronic products.

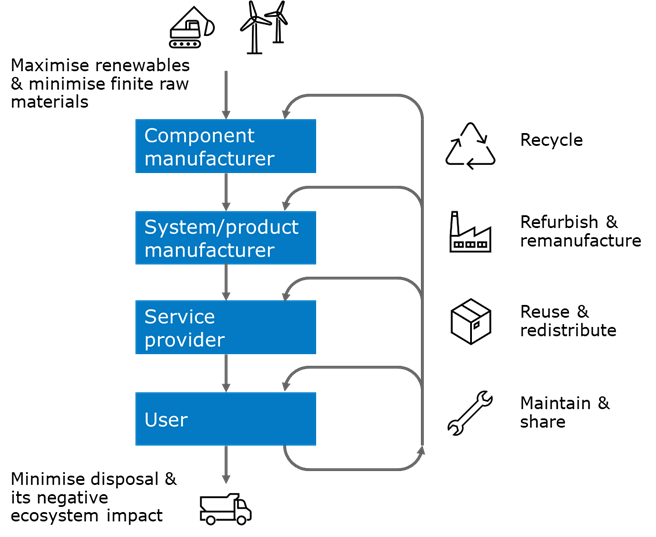

Circularity, in the context of sustainability and resource management, refers to an economic and production model that aims to minimize waste, optimize the use of resources, and promote the continual reuse, recycling, and regeneration of materials and products. This concept is in contrast to the traditional linear economy, which follows a "take-make-dispose" pattern, leading to significant resource depletion, environmental degradation, and waste generation.

Circularity involves several key principles (see Figure 1):

Design for Longevity—Products are designed to have an optimally extended lifespan, using durable materials and construction techniques to ensure the electronic system can be used for as long as possible.

Reuse and Repair—Emphasis is placed on repairing and refurbishing products instead of discarding them. This prolongs their useful life and reduces the need for new production.

Remanufacturing—Products are designed and manufactured in a way that allows their components to be easily disassembled and reused in new products, reducing the demand for virgin resources.

Recycling—Materials are recovered from products at the end of their life cycle and processed to create new materials, reducing the need for raw materials extraction.

Resource Efficiency—Processes are optimized to minimize waste and energy consumption throughout the entire product life cycle.

Sharing Economy—Resources are shared among multiple users, reducing overall demand and optimizing utilization. Examples include cloud services, ride-sharing services and co-working spaces.

Bio-based Materials—Renewable and biodegradable materials are used to replace non-renewable and environmentally harmful materials.

Intelligent Digital Solutions—Technologies such as blockchain and artificial intelligence/machine learning (AI/ML) are used to track and optimize resource flows, improve supply chain transparency, and enable efficient recycling and reuse.

Figure 1: One half of the Ellen MacArthur Foundation butterfly diagram for circularity: The technical cycle.1

The shift towards a circular economy requires collaboration among governments, businesses, consumers, and other stakeholders. It involves rethinking product design, business models, and consumption patterns to create a more sustainable and resilient economic system that aligns with the principles of environmental conservation and long-term well-being. In the following tables for Needs, Gaps and Challenges, as well as Potential Solutions, social and economic considerations can factor more strongly than technology.

Circularity in the Electronics Industry

Circularity presents many areas of opportunity for the electronics industry, as follows:

Innovation and Design—Sustainable design practices are gaining momentum, focusing on modular and upgradable products, as well as using eco-friendly materials that are easier to recycle.

Electronics as a Service—Cloud and other asset-management solutions will continue to grow in the business-to-business (B2B) sector. We can already see elements of this in the business-to-consumer (B2C) large-volume goods like smart phones, where carriers are setting up mechanisms for device renewal and reuse through financial incentives such as generous trade-on allowances.

Circular Economy Initiatives—Initiatives like the “right-to-repair movement”, take-back programs, refurbishment, and remanufacturing are gaining traction around the globe.

End-of-Life—Customers of the electronics industry generate a significant amount of electronic waste (e-waste) due to rapid technological advancements and short product lifecycles. Efforts have been made to improve e-waste management through recycling programs, proper disposal, and regulations. However, e-waste remains a concern, especially in developing countries where informal recycling practices have led to environmental and health hazards.2

Technical Needs, Gaps and Solutions

The technology issues surrounding Circularity, the associated needs, technology status of those needs, as well as gaps and challenges to overcome, are summarized below. The time period considered is from 2023 to 2033.

Technology Status Legend

For each need, the status of today’s technology is indicated by label and color as follows:

In-table color + label key | Description of Technology Status |

|---|---|

Solutions not known | Solutions not known at this time |

Solutions need optimization | Current solutions need optimization |

Solutions deployed or known | Solutions deployed or known today |

Not determined | TBD |

Definitions for “Gap,” “Challenge,” and “Current Technology Status” are below:

Term | Definition |

|---|---|

GAP | This is what is missing or what below in performance, in today’s technology, to meet the need for year X. |

CHALLENGE | Why is it difficult to meet the need in year X? Typically, this is some particular technical consequence of that need that is inherently difficult. |

CURRENT TECHNOLOGY STATUS in year X | How well does today’s technology and solutions meet the need in year X? |

Table 1. Circularity Gaps, and Today’s Technology Status with Respect to Current and Future Needs

| ROADMAP TIMEFRAME | |||

TECHNOLOGY ISSUE | TODAY (2023) | 3 YEARS (2026) | 5 YEARS (2028) | 10 YEARS (2032) |

Issue #1 Recognize individuals as leaders among industry change agents, distinguishing between those who excel in thought leadership and those with the power to enact change | ||||

NEED | Industry takes the lead. Make a priority to key leaders (industry) as operational policy | Industry to encourage gov’t to assist in transition (w/ credits, rewards, etc.) for industry actions (versus regulations) Industrialization underway for economic benefits | Change agents within “start-up” push timeline for adoption/change. These are problem solvers and the people-resource base. | Cultural change underway |

CURRENT TECHNOLOGY STATUS | Industry collaboration initiatives beginning3 | |||

GAP | Lack of collaboration/ joint industry projects due to resource/ budget limitations | |||

CHALLENGE | Political elements | |||

CHALLENGE | Over regulating increases burden on industry resulting in less than optimum solution | |||

CHALLENGE | Missing full mandate from company leadership | |||

CHALLENGE | Government and purchasers not in lead roles and decision making | Technology evolves with both solutions but also new issues (robotics, AI, etc.) | ||

NEED | Environmental, social, and governance (ESG) impacts drive corporate investment for accountability / visibility | Accountability and reporting becomes a focus and public-facing | Shift away from increasing production volume as a target to minimizing effort/resource + maximizing use/impact on life quality | |

CURRENT TECHNOLOGY STATUS | “Steady state” growth for balance | |||

GAP | Lack of will across the electronics supply chain (perception of expense versus monetary benefit, difficulty to implement, etc.) | Lack of consensus of what data is needed and measured to inform decision making. Need data sharing and harmonization along the supply chain to change priorities | Trend is accelerating towards more growth and revenue/more profit (mergers/acquisitions) | |

CHALLENGE | Budget and resources restraints resolutions not a priority | Generational change for this to occur | ||

CHALLENGE | Ideological and political barriers | Unlikely without major disruption within industries (natural or manmade) | ||

Issue #2 Consumer mindset and education | ||||

NEED | Consumers to ask and force companies to provide them, "ease of participation" by collecting old products from homes like the delivery of new products | Consumer mindset to want more sustainable products, but will still need the infrastructure and education to know how to handle and live with them | Consumer mindset to evolve as they see and hear circularity efforts from mainstream players in the market for electronics. Change in culture through financial incentives, marketing, "be happy to buy used" | Increase in consumer demand for ultra-long life and upgradeable software electronics |

CURRENT TECHNOLOGY STATUS | N/A | |||

GAP | Regional programs only, e.g., the EU’s WEEE Directive4 | |||

CHALLENGE | Consumer education / awareness | |||

Issue #3 Business Model for Reuse | ||||

NEED | Ease the pain of reuse for those buying and selling products. Have an open and fair marketplace of items available for reuse | Pilots and models developed for scale-out for regional reuse | Variety of circularity models established at scale: | |

CURRENT TECHNOLOGY STATUS | In limited practice | |||

GAP | Built-in and technology obsolescence (Business aspect) (Many device reuse cycles are well established but hardware/ software compatibility is a limiting factor)(Product churn) | |||

GAP | Lack of ongoing support of old products / hardware (firmware / software). | Lack of understanding and slow uptake of digital decentralized (web3) marketplace to drive reuse | ||

CHALLENGE | This is a disruptor. Competes with new products. Cost and CO2 for transportation and recovery. | Who will establish and operate this market? Undercutting of reuse by low-costing new products for company / country supremacy. Companies set up for recovery | Increasing volume and reducing cost to operators for ease of action. Few networks / consortiums for reuse | |

CHALLENGE | Lack of collaboration with circular life cycle partners (collection, reverse logistics and recycling partners) and insight into the companies projected life cycle for newly developed products | |||

NEED | Guidelines needed for company metrics for reuse and reusability | Company ESG or sustainability reports need to include reusability | Meet shareholder demands through incorporating reuse | Standardized reporting of metrics on reusability |

TECHNOLOGY STATUS |

| |||

GAP | No alignment on metrics | Demands being met by standards | ||

Issue #4 Recycle and Reuse of Materials for Production Electronics Link to Materials Tables | ||||

NEED | Technologies for responsible recycling for materials | Meet responsible recycling needs for new materials in products with short lifetime | Meet responsible recycling needs for new materials in products with medium lifetime | Meet responsible recycling needs for new materials in products with long lifetime |

CURRENT TECHNOLOGY STATUS | Solutions need optimization (depends on materials) | |||

GAP | Plastics separation, identification and economics | Scalable, automated entification and separation / depolymerization techniques | Economic, automated identification / separation / depolymerization techniques |

|

CHALLENGE | Cost (economics of recycling by type, e.g., plastic types), consistent feed, quality, | Project most economic output materials in the future and target locations near sources | Targeted valuable material piloted | Valuable products scale-up |

CHALLENGE | How to sell recovered materials (integrated back into the supply-chain.) | How to build a robust, assured, well controlled recycler-supplier network to meet the responsible recycling needs – taking on short-term challenges | How to enable a robust, assured, well controlled recycler-supplier network to meet the responsible recycling needs – taking on mid-term challenges | How to support a robust, assured, well controlled recycler-supplier network globally to meet the responsible recycling needs – taking on long-term challenges |

CHALLENGE | Insufficient availability of safe and high-quality materials for designers and engineers to use, due to lack of circular supply chain collaboration and innovation in line with what electrical and electronic companies need and a lack of understanding of the performance properties of these materials. | |||

NEED | Critical/strategic materials recapture as uniform with known take-back loops | New non-pyro recycling technologies (such as hydro and bio at ambient temps) | ||

CURRENT TECHNOLOGY STATUS | Solutions deployed for high-value, easy-to-recycle materials | Solutions not known | ||

GAP | Aluminum, steel, copper, gold, solder well established, less so for plastics, glass, silicon | High-volume solar panel end-of-life (EOL) scaleup5; economic recovery of silicon, glass, silver, copper, lithium, polyvinyl butyral (PVB) | ||

CHALLENGE | Extraction technology for reuse | Chemical recycling development | Chemical extraction economic | Chemical extraction scale-up |

Issue #5 Metrics and methodologies | ||||

NEED | Assessing the ecological impact: identifying relevant impacts, selecting appropriate methods and databases, and exploring reporting mechanisms such as the EU DPP and comparable frameworks. | Need to update and improve on measurement techniques addressing other industry segments | ||

CURRENT TECHNOLOGY STATUS | Solutions need optimization | Solutions need optimization | ||

GAP | Disjointed efforts for measurement, updating and sharing results. International Telecommunication Union (ITU) standard developed and in process of adoption (e.g., communication service providers (CSPs)) but refinement and analytics are needed. | |||

CHALLENGE | Getting industry aligned on metrics and methodologies | |||

CHALLENGE | Willingness to share IP for eco-measurement | |||

CHALLENGE | Insufficient actionable/concrete training for designers and engineers on the circular economy, life cycle phases, evaluation and analysis as well as the appropriate circular solutions focusing on concrete tangible targets. | |||

CHALLENGE | Lack of shared best practices, circular economy case studies, and success stories at scale | |||

Issue #6 Promoting repair and refurbishment of existing equipment | ||||

NEED | Compliance for “Right to repair” regulations? | |||

CURRENT TECHNOLOGY STATUS | ||||

GAP | Economics for small products (profitability) | |||

CHALLENGE | Establish a transparent, robust and easy-to-transact marketplace for promoting R2 of existing equipment | How to achieve attractive economic opportunities in countries with high labor cost -> to be able to repair, refurbish products | ||

CHALLENGE | Lack of coherent (design) strategies on safe disposal of data produced, processed, and stored. | |||

Issue #7 Technology for separation for recycling (Link to Materials section for Digital Passport) | ||||

NEED | Product information and materials knowledge | High tech capabilities of separation (mechanical and chemical) | Standardized high tech capabilities in the Organization for Economic Cooperation and Development (OECD) | Standardized high tech capabilities in worldwide |

CURRENT TECHNOLOGY STATUS | Low and patchwork | Advances in separation and recovery technology | Wider spread used of new technologies | |

GAP | Lack of available info | Demand for innovation | Regional demand | Global economy for recovered materials |

CHALLENGE | How to efficiently address the plethora of info needed for each product | Business/profit model in innovation | ||

Issue #8 Increasing participation in the “circular economy” | ||||

NEED | Immediate payback and incentivization (paradigm shifts) | |||

CURRENT TECHNOLOGY STATUS | Solutions need optimization | |||

GAP | Corporate resources / budget | Corporate resources / budget for smaller industries | ||

CHALLENGE | Paradigm shift to prioritize end-of-life strategies into central organizational models with strategic business / ESG plans and goals | What is the corporate model, e.g,, mindset of combination of mixed/new components reuse | ||

CHALLENGE | Lack of collaboration with circular lifecycle partners (collection, reverse logistics and recycling partners) and insight into the companies projected life cycle for newly developed products | |||

Issue #9 Reuse/repurpose components for product repair/refurbishment/remanufacturing/remanufacturing6 | ||||

NEED | Reuse of simpler components: e.g. memories, DSPs, low-cost components/discrete | Automation of deconstruction and extraction of components | Scale recovery based on assured marketplaces for high transparency, trackable information for purchasers | |

CURRENT TECHNOLOGY STATUS | Solutions need optimization | Solutions need optimization | Solutions need optimization | |

GAP | Many components not economic for reuse | |||

CHALLENGE | Lack of joint R&D efforts, proponents, funding, incentives | Perception/stigma of used materials for selling of used components in “new” product. (Mix of new and old.) | ||

CHALLENGE | Reliability | |||

Issue #10 Robust consumer marketplace for electronics exchange and recycle (make it easy) | ||||

NEED | Easy and inexpensive means to visualize market demands, assess values, and transact / exchange efficiently | New business models and new market players: "Vinted" for consumer electronics, peer-to-peer (P2P) platforms, for example | Shift to leasing not owning, equipment. “Hardware-as-a-Service” model | |

CURRENT TECHNOLOGY STATUS | Wireless carriers smartphone trade-in and device insurance | Other industries emulate the wireless model. | Pilot recovery techniques based on assured marketplace (WEB3 for electronics exchange) for high transparency, trackable information for bidders | Scale recovery |

GAP | Lack of a wide scale (yet tailored to regional demands) decentralized marketplace | Some regions will be slower than others to adopt this model | ||

CHALLENGE | Joint efforts to form decentralized marketplace (web3-based) | |||

CHALLENGE | Multiple centralized marketplaces tend to promote competing, isolated exchanges with poor visibility and value propositions | |||

Issue #11 Education, awareness training and workforce empowerment (building teams, collectives and public communities) | ||||

NEED | Buy-in from stakeholders | Courses, modules, and training materials, e.g., for micro-credential-based courses | Pilot project and program | Circularity content fully integrated into education and training practices |

CURRENT TECHNOLOGY STATUS | N/A | |||

GAP | Limited courses offered | Efforts are sporadic and not coordinated | Efforts limited to one program | |

CHALLENGE | Credit hour cap of programs | Interdisciplinary nature of the content; On-going research (content not well established) | Working across degree programs | Scale of change on curriculum |

Issue #12 Design for repair, reuse, recycle (products, tools, market, [many factors…], affordability of 2nd life..) | ||||

NEED | Commonality of Design-for-R’s, sharing of technical expertise, best practices, joint projects & studies | Design guidelines for common systems and components | Cost and benefit analysis of design for Rs options | Fully integrated tools support design for 3Rs |

CURRENT TECHNOLOGY STATUS | Solutions need optimization | Solutions not known | Solutions not known | Solutions not known |

GAP | Willingness to promote – what’s in it for me (to share, work jointly) | EoL not considered in design | only qualitative/empirical information available | Tools focus on technical performance and segregated |

CHALLENGE | Complexity of design element. Conflicts with other design imperatives (e.g. features) | Overloading designers | Potential tradeoffs make decision making complicated7 | Tools integration with easy to use interface |

Issue #13 Addressing critical raw and strategic materials at regional level (for ID circularity intersections) (conserving, replacing, etc.) | ||||

NEED | Knowledge of critical raw materials (CRMs) in supply chain components and materials. (Proposed EU Corporate Sustainability Reporting Directive regulations will require their use assessment and reporting.) | Suitable efficiency measures or substitutions / alternatives. Link suppliers back into the reverse supply chain. | Introduction of new materials requires review and revision of the list of critical and strategic materials and methods | |

CURRENT TECHNOLOGY STATUS | Solutions need optimization | Solutions not known | Solutions not known | |

GAP | Lack of sufficient knowledge | Lack of substitutions | ||

CHALLENGE | Sharing CRM information available for the broad set of components and materials along the full supply chain. | Design changes may be needed when using substitutions. | ||

Issue #14 Digital product passport - See Materials Section | ||||

Information to help EOL processes | ||||

Approaches to address Needs, Gaps and Challenges

Table 2 considers approaches to address the above needs and challenges. The evolution of these is projected out over a 10-year timeframe using technology readiness levels (TRLs).

In-table color key | Range of Technology Readiness Levels | Description |

|---|---|---|

2 | TRL: 1 to 4 | Levels involving research |

6 | TRL: 5 to 7 | Levels involving development |

9 | TRL: 8 to 9 | Levels involving deployment |

Table 2. Circularity Potential Solutions

|

| EXPECTED TRL LEVEL* | |||

TECHNOLOGY ISSUE | POTENTIAL SOLUTIONS |

| 3 | 5 | 10 |

Issue #1 Recognize individuals as leaders among industry change agents, distinguishing between those who excel in thought leadership and those with the power to enact change (e.g., pedigree in sustainable actions.). | Create an annual high-level summit for C-level executives and leaders to discuss and identify sustainable solutions in line with brand identity. Showcase leaders in sustainability, including second-tier participants, to highlight circularity as a business model. Emphasize positive impact statements, value propositions, success stories, and good outcomes to demonstrate business opportunities in sustainability. | 4 | 8 | 9 | 9 |

Identify actionable items by consensus | 4 | 8 | 9 | 9 | |

Pursue grants and subsidies | 2-3 | 7 | 8 | 9 | |

Issue #2 Consumer mindset and education | Industry to establish single voice targeting consumers for ideation of sustainable evolution of microelectronics (right to repair, need to recycle, etc.) from “dispose and buy” (IPC, IEEE, INEMI, …) | 2 | 8 | 9 | 9 |

Issue #3 Business Model for Reuse | Distributed, verifiable marketplace for high-end ICT (e.g., telco, data center items) (e.g., certified parts). Web 3 approach using block chain | 6 | 9 | 9 | 9 |

Distributed, verifiable marketplace for the recycling and reuse of enterprise-grade equipment | 6 | 9 | 9 | 9 | |

Distributed, verifiable marketplace for the recycling and reuse of consumer equipment | 4 | 6 | 9 | 9 | |

“Electronics as a service”/leasing model for high-end and enterprise equipment | 6 | 8 | 8 | 9 | |

Available, affordable technology and adoption of low-carbon infrastructure for reverse logistics (ground transport, air, rail, water) | 8 | 8 | 9 | 9 | |

Carriers need to be involved to establish reverse logistics network (e.g., Amazon/UPS partnership) for international shipments | 8 | 8 | 9 | 9 | |

Agreements with metrics for carbon emissions in reverse logistics | 7 | 8 | 9 | 9 | |

Establish standards for reverse logistics with, e.g., International Safe Transport Association (ISTA), International Association of Packaging Research Institutes (IAPRI), etc. | 3 | 6 | 9 | 9 | |

Issue #4 Recycle and Reuse of Materials for Production Electronics | Enclosures with easily recyclable materials | 8 | 9 | 9 | 9 |

Enclosures that are difficult to recycle (e.g., ABS and other flame retardant materials) – chemical extraction | 2 | 4 | 6 | 8 | |

Enclosures that are difficult to recycle (e.g., ABS and other flame retardant materials) – re-extrusion + remolding | 7 | 8 | 9 | 9 | |

PFAS materials – separate out from existing, legacy materials using spectroscopic sensing, AI analysis and robotics, usable for broad range of equipment | 6 | 8 | 9 | 9 | |

PFAS materials – substitution | 4 | 6 | 8 | 9 | |

Issue #5 Metrics and methodologies | DPP (digital product passport) introduction | ||||

Alignment and standardization of metrics and methodologies for circularity (incl. environmental footprint, e.g. recyclability EN R45555 2019)8 | 6 | 8 | 9 | 9 | |

Alignment and standardization of metrics and methodologies for carbon footprint measurement – ISO 14040, 140449, 10 | 9 | 9 | 9 | 9 | |

New product category rules for carbon footprints specific to electronics | 7 | 8 | 9 | 9 | |

Lifecycle primary data on carbon footprint for advanced materials, components and products; moving away category rules/assumptions | 5 | 8 | 8 | 9 | |

Lifecycle primary data on carbon footprint for simple materials, components and products | 9 | 9 | 9 | 9 | |

Issue #6 Promoting repair and refurbishment of existing equipment | B2B repair and refurbishment with tradition reverse logistics | 9 | 9 | 9 | 9 |

Scaled up ecosystem for consumer electronics repair and refurbishment: hub system needed – extend online sales product return infrastructure – high-value electronics | 8 | 9 | 9 | 9 | |

Scaled up ecosystem for consumer electronics repair and refurbishment: hub system needed – extend online sales product return infrastructure – medium-value electronics | 7 | 8 | 9 | 9 | |

Development of global networks for refurbishment (redistribution leg) – high-value electronics | 8 | 9 | 9 | 9 | |

Issue #7 Technology for separation for recycling | Regulations on materials composition of electronic products to make information available (e.g., labeling) as part of the digital product passport | 6 | 7 | 8 | 9 |

Industry standards on materials composition of electronic products to make information available (e.g., labeling) as part of the digital product passport | 5 | 6 | 7 | 8 | |

Full-spectrum inspection with AI for electronics extraction from municipal waste | 3 | 6 | 8 | 9 | |

Robotics + AI for mechanical disassembly of electronics into valuable components (e.g, de-soldering, material separations, etc.) | 5 | 7 | 8 | 9 | |

Deployment of separation technology world-wide | 1 | 2 | 6 | 8 | |

Issue #8 Increasing participation in the “circular economy” and incentives | National/regional approaches to taxes, certifications, credits, etc. (Incentives for collectives (certifications, rebates, credits, exchange offers, etc.) | 7 | 7 | 8 | 9 |

Industry approaches to credit offers, exchange offers, etc. for B2B market | 9 | 9 | 9 | 9 | |

Common industry approaches to rebates/credit for new product, exchange offers, etc. for consumer electronics market | 7 | 8 | 9 | 9 | |

Issue #9 Reuse/repurpose components for product repair/ refurbishment/ remanufacturing/ remanufacturing6 Reliability over extending lifetimes + over multiple solder/de-solder cycles | Informal grey markets for recovered chips and boards | 8 | 8 | 8 | 8 |

Reliability testing standards, backed by modelling and testing | 5 | 7 | 9 | 9 | |

Well-regulated markets for recovered chips and boards | 7 | 7 | 8 | 9 | |

Issue #10 Robust marketplace for electronics exchange and recycle (make it easy) | Carbon-based trading incentives for collectives (certifications, rebates, credits, exchange offers, etc.) | 8 | 8 | 9 | 9 |

Commercial pricing premium for higher recycled content (consumer electronics) | 8 | 8 | 8 | 9 | |

Issue #11 Education, awareness training and workforce empowerment (building teams, collectives and public communities) | Workforce education and development | 7 | 8 | 8 | 9 |

Issue #12 Design for repair, reuse, recycle (products, tools, market, [many factors…], affordability of 2nd life..) | Modular design (including hot-swap ability), easy chip replacement, software updates, B2B | 9 | 9 | 9 | 9 |

Right-to-repair B2C – modular designs running against ever-increasing integration, building in functionality and physical integrity | 6 | 7 | 8 | 9 | |

Issue #13 Addressing critical raw and strategic materials at regional level (Identify circularity intersections) (conserving, replacing, etc.) | Alternative extraction methods for CRMs like gallium and germanium | 8 | 8 | 9 | 9 |

Alternative extraction and recycling methods for rare earth metals | 6 | 8 | 9 | 9 | |

Recycling methods for post-consumer lithium batteries | 7 | 8 | 9 | 9 | |

Issue #14 Digital product passport | |||||

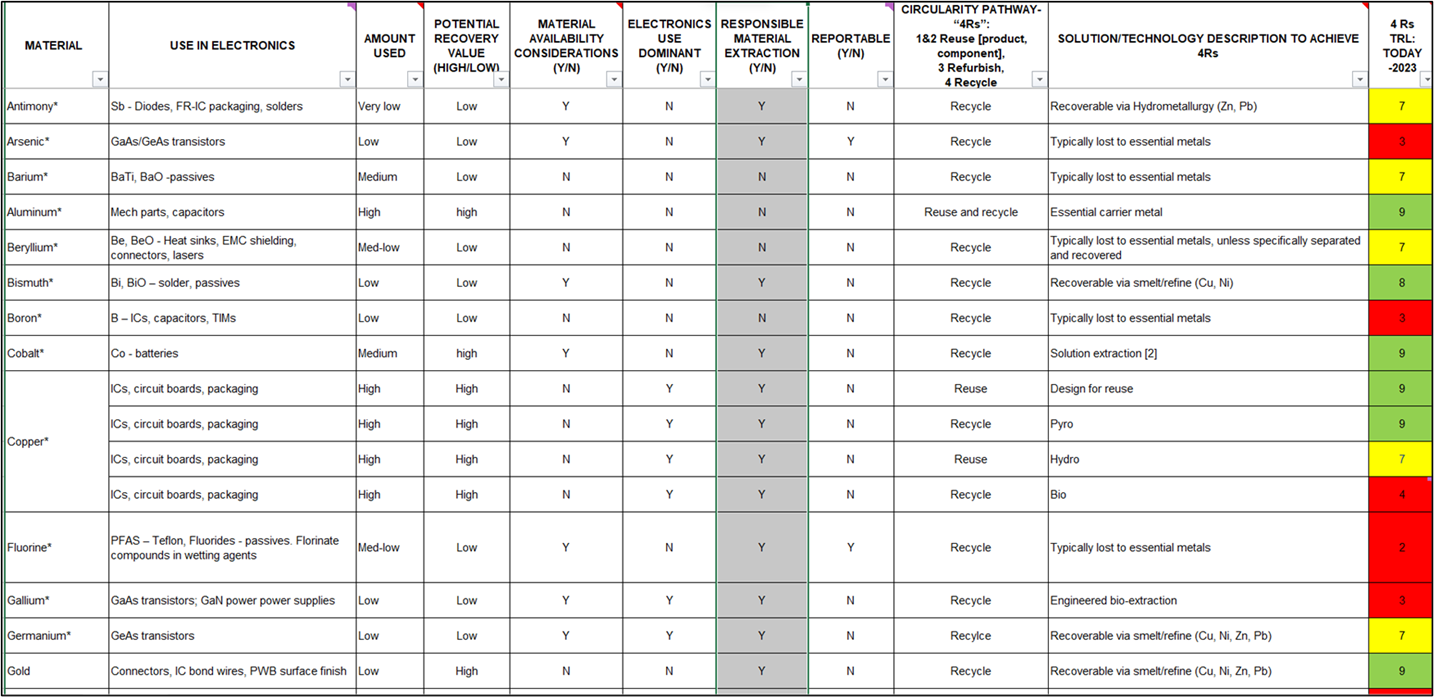

Circularity Critical Materials: 4Rs

The iNEMI roadmap team developed a comprehensive table of materials with considerations to use in electronics, potential recovery value, availability, circularity pathway with respect to the 4Rs, solutions to achieving such a pathway, and a timeline of readiness level. It is available as an interactive spreadsheet for general use as well as compounds for printed circuit board applications.

Table 3 Critical Materials’: Reuse/Refurbish/Recycle, Example of Materials Table

Link to the Materials Table page.

Conclusions

Circularity is a key part of sustainable electronics. By closing the material loop, resource utilization can be maximized while waste produced over life cycle can be minimized. Promoting circularity within the electronics industry is closely related to material selection and supply chain management. There are also unique challenges due to the involvement of many stakeholders. The roadmapping efforts have identified the following issues:

Leadership for change—Industry should take the lead on the circularity transition. We expect some companies will act as the leading change agents to demonstrate a new value proposition with financial success and thus help followers to navigate the new space. As a more environmentally conscious generation becomes corporate leaders, this trend will accelerate.

Business model—Circularity requires significant changes to the manufacturing business model, likely from product-oriented to service-oriented, e.g., towards electronics-as-a-service. Developing a tiered market could also extend product use life. New business models may be needed to extend the current collection and recycling networks. Financial incentives from governments and sources will help the development and adoption of the new business models.

Metrics and methodology—Although there are many metrics and methodologies that have been developed for circularity, one suitable for electronics remains to be established and standardized. Industry consensus is very important to maintain a level playing field.

Technologies to support cost-effective reuse, remanufacturing, and recycling—Business-to-business reuse, remanufacturing, and recycling have made significant progress while consumer electronics face challenges and the efforts need to be scaled up. New technologies and approaches are needed to overcome the hardware and software limitations for reuse and remanufacturing and to find pathways for currently unusable and unrecyclable components. It is also critical to make sure recovered components and materials find entry into production, while still assuring reliability. There is also increasing pressure on resolving critical and strategic materials challenges. It is expected that the standardization and adoption of digital product passport technologies and practices could facilitate the development of these technologies.

Education—Workforce development and training of engineers in practice are needed to promote circularity. Efforts should be put into the development of new modules, courses, certificates, and programs. In addition, outreach to the public is also important to change consumer mindset.

Product design for circularity—The current design paradigm takes does not take circularity into consideration. This approach makes finding cost-effective reuse, remanufacturing, and recycling pathways extremely difficult. A proactive design approach with circularity in mind and the development of supporting tool capabilities can greatly optimize effective end-of-life management efforts, while not compromising on product performance and reliability.

Acronyms Table

References

Ellen MacArthur Foundation, “The Technical Cycle of the Butterfly Diagram,”

https://www.ellenmacarthurfoundation.org/articles/the-technical-cycle-of-the-butterfly-diagram , 2022.

Lynda Andeobu, Santoso Wibowo, and Srimannarayana Grandhi. National Institutes of Health. Int J Environ Res Public Health. 2021 Sep; 18(17): 9051. A Systematic Review of E-Waste Generation and Environmental Management of Asia Pacific Countries. https://www.ncbi.nlm.nih.gov/pmc/articles/PMC8430537/.

Published online 2021 Aug 27. doi: 10.3390/ijerph18179051. PMCID: PMC8430537. PMID: 34501640Circular Electronics Partnership (CEP): https://cep2030.org/

EU, “Waste from Electrical and Electronic Equipment (WEEE)”,

https://environment.ec.europa.eu/topics/waste-and-recycling/waste-electrical-and-electronic-equipment-weee_en , August 2012.

Jon Hurdle, “As Millions of Solar Panels Age Out, Recyclers Hope to Cash In”,

Yale Environment 360, 28 February 2023.

Remanufactured means to certify like “original, new.” https://www.dxpe.com/what-does-remanufactured-mean-vs-refurbished-rebuilt-reconditioned/

Dahmus - “What gets recycled,” 2007

EN R45555 2019 - https://standards.iteh.ai/catalog/standards/cen/a6432062-6e44-4011-9720-fcbc99e61feb/en-45555-2019

ISO 14040. https://www.iso.org/standard/37456.html

ISO 14044. https://www.iso.org/standard/38498.html

Klaus Grobe, “Energy Efficiency Limits to ICT Equipment Lifetime”, ITG-Fachbericht 305: Photonische Netze, Berlin, 18-19 May 2022.