Materials

Introduction

Material selection and utilization play a key role in developing sustainable electronics. Here we cover all materials involved in manufacturing electronic products and systems, including those used in material processing but not ending up in the final product. Also, a full product life cycle is considered from raw material acquisition to end of life management. Sustainability issues could come from occupational exposure, environmental releases, and responsible supply chain.

Through roadmapping, we will analyze the current status in key areas, identify anticipated needs over the next 10 years and highlight the gaps, and challenges to achieving them, including suggesting potential solutions. The focus for this roadmap effort is on the technology implications rather than mapping the regulatory landscape.

This Materials section of the Sustainable Electronics Roadmap is part of the holistic approach for the roadmap. Other sections include Circularity, Responsible Supply Chain, and Energy and Water.

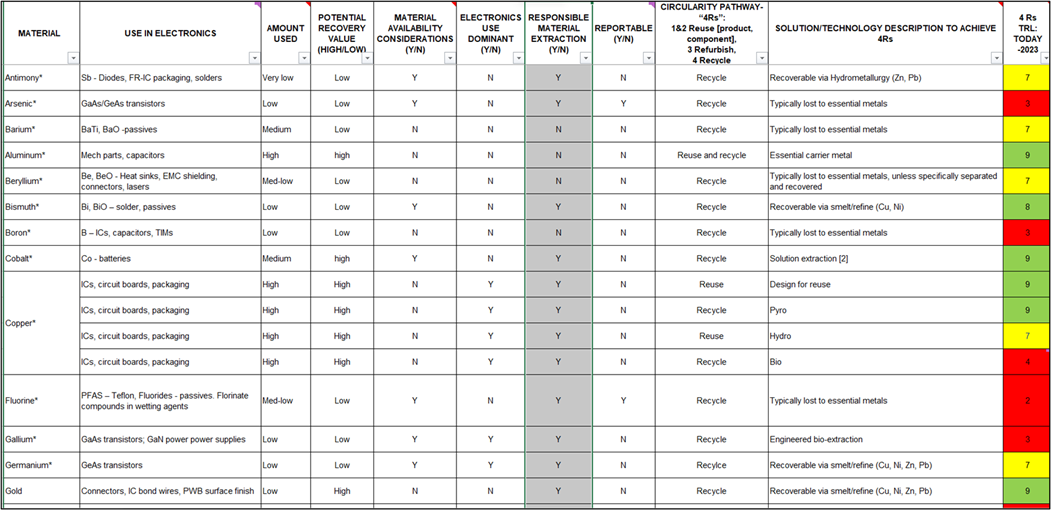

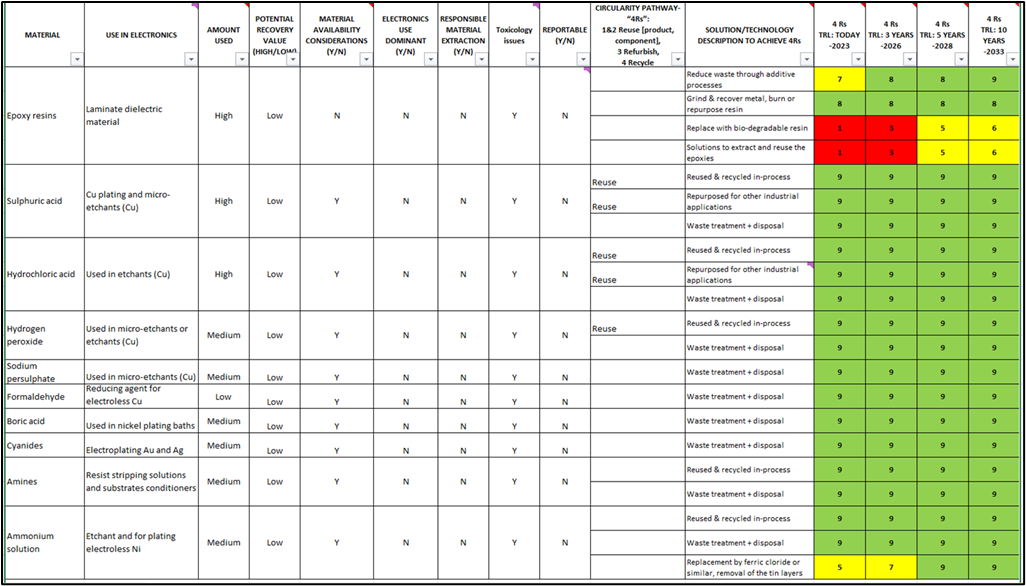

Technical maturity of various approaches to recycling and reuse of different materials is considered in Materials Tables. These tables list the TRLs for each material for various recycling technologies, as well the major sustainability issues, ranging from toxicology to material availability.

Today’s Landscape

Many leading electronics manufacturers have set aggressive goals for carbon neutrality. All materials used in the electronics industry may contribute to global warming directly (e.g., fugitive emissions) and/or indirectly (e.g., due to fossil-fuel energy consumed during material production). In this section, we only consider materials that lead to direct greenhouse gas emissions. For example, SF6 and C2F6, two common etchants used in semiconductor manufacturing, are among the most powerful greenhouse gases with extremely long atmospheric lifetime. Greenhouse gas releases due to energy use is covered in the Energy section of the roadmap.

Due to human health and ecotoxicity concerns, regulations have been enacted to phase out the use of certain materials e.g., RoHS and recent and future restrictions on per- and polyfluoroalkyl substances (PFAS). In the past, the electronics industry has been largely reactive to these regulations. This approach may be costly, and the solutions selected may not be the optimum. It is desired that the electronics industry will work together with regulation bodies to be proactive.

Electronics industry relies on many materials that are subject to supply chain disruption. Production of these materials is highly concentrated in regions where geopolitical conditions may cause issues for the electronics industry to have secure access to these materials. Building a secure and socially responsible supply chain for these critical materials is a key issue to address,

As electronics industry adopts the concept of circular economy, attention should be paid to material selection as this will greatly affect product re-use, remanufacturing, and recycling. Having a digital product passport with material composition information will facilitate end of life product management to close the material loop.

Technical Needs, Gaps and Solutions

Electronic materials’ critical technology issues, their needs and their related potential solutions to address those needs are presented as tables. A roadmap timeline with milestones are noted as of today, and at three, five and ten years (2023, 2026, 2028, 2033).

Overarching microelectronic materials’ critical technology issues were identified as follows:

Restriction of PFAS substances in the European Union (EU) which will impact the entire ecosystem

Proactive future material and substances substitution (industry determines its own future versus being required by law) to mitigate toxicity risks

Information/disclosure about presence of materials in product (e.g., digital product passport)

Materials’ selection to support circularity.

Materials’ selection to reduce non-energy greenhouse gas emissions

Materials’ selection due to competitions among influential companies vs. small

Materials’ selection due to supply chains.

In Table 1, technology issue needs are further explored individually in several dimensions, as follows:

Current technology status is indicated, based on today’s knowledge of available (known versus unknown) solutions for resolving that need, as follows: Solutions Not Known (light blue); Solutions need Optimization (blue); Solutions Deployed or Known Today (purple), or Technology Status not determined (grey).

Gaps with satisfying a need are noted.

Challenges to be understood and resolved in order to resolve such gaps and satisfy needs are listed.

Potential Solutions (Table 2) is aligned with Table 1 technology issues. Based on today’s perspectives, the Materials roadmap sub-team lists one or more solutions for each technology issue and grades each solution with a technology readiness level. (The definitions of TRLs can be found at this link: https://inemi-roadmap.scrollhelp.site/ir/technology-readiness-levels-trls .)

Technology Status Legend

For each need, the status of today’s technology is indicated by label and color as follows:

In-table color + label key | Description of Technology Status |

|---|---|

Solutions not known | Solutions not known at this time |

Solutions need optimization | Current solutions need optimization |

Solutions deployed or known | Solutions deployed or known today |

Not determined | TBD |

Definitions for “Gap,” “Challenge,” and “Current Technology Status” are below:

Term | Definition |

|---|---|

GAP | This is what is missing or what below in performance, in today’s technology, to meet the need for year X. |

CHALLENGE | Why is it difficult to meet the need in year X? Typically, this is some particular technical consequence of that need that is inherently difficult. |

CURRENT TECHNOLOGY STATUS in year X | How well does today’s technology and solutions meet the need in year X? |

Table 1. Materials Gaps, and Today’s Technology Status with Respect to Current and Future Needs

| ROADMAP TIMEFRAME | |||

TECHNOLOGY ISSUE | TODAY (2023) | 3 YEARS (2026) | 5 YEARS (2028) | 10 YEARS (2032) |

Issue #1 Restriction of PFAS substances in the EU (entire ecosystem) | ||||

NEED | Technical data on PFAS usage available. | Final text for data and exemptions that are defensible (like RoHS exemption process) | New inventions and substitutes Cycles of defense of substitutions and review | Substitutions in practices and deployed in new products/development/processes |

CURRENT TECHNOLOGY STATUS | Some exceptions already underway globally | Information provided on applications where no substitutions | Possibly effective by 2027. Many restrictions in place and phase out underway | 100% restrictions in place for new products/development/ processes |

GAP | Technical solutions | Technical solutions | Technical solutions | Technical solutions |

CHALLENGE | Does not have the benefits of reuse | Dependency on how successful defense for transition time and/or extensions for reuse/repair | Dependency on how successful defense for transition time and/or extensions for reuse and repair | |

CHALLENGE | Industry needing to adopt a 2-prong approach | |||

Issue #2 Proactive future material and substances substitution | ||||

NEED Industry-wide collaborative effort to guide/lead proactively materials’ substitutions | Regulatory-led effort for materials’ substitutions | Industry to begin list of alternates on its own (timelines, specs, etc.) | Industry develops list of alternates on its own (timelines, specs, etc.) for adoption. Establish communication channels with regulators, suppliers, etc. | Ongoing selection of new materials selection is “green” with best practices becoming the norm within the electronics industry. Industry will socialize this with regulators on an on-going basis to build trust and get their input. |

NEED | Original equipment manufacturers (OEMs), component suppliers not aligned/in agreement on specific cases with respect to flame retardants (start with brominates)– | Emergence of cross-industry consensus on specific use-cases and approach to flame retardants | Materials and process development underway for flame retardants | Industry-led practices are in the marketplace for flame retardant materials |

TECHNOLOGY STATUS | No consensus on solution. | General agreement on direction (solutions not identified) | ||

GAP | Equipment manufacturers are moving towards halogen-free/reducing brominated materials. | |||

CHALLENGES | Definition of flame retardant | Perceptions that it is a large effort to qualify new materials (reliability concerns) so the challenge is to make qualifying new materials easier | ||

CHALLENGES | Disagreement with approach--“right” chemistries going forward versus complete ban | |||

NEED | Self-identification of materials to be substituted, as motivations and situations (illness/environment, conflict materials, strategic) become known | |||

CURRENT TECHNOLOGY STATUS | ||||

GAP | Identification and knowledge of materials needs to be recognized for early actions proactively rather than decades after identification | |||

GAP | Exemptions requested and unwillingness to comply due to perceived hardships | |||

CHALLENGE | Reluctance to take action and so it is left up to “early movers” | |||

CHALLENGE | Industry perception this is a “Huge project and hardship” that then drives no action and reluctance | |||

CHALLENGE | Materials are embedded 3-4 levels "down" in supply chain: Materials are not selected by OEMs, but instead selection is by the manufacturers of components. (E.g., encapsulants. | |||

CHALLENGE | Process chemicals are problematic: new chemicals may fall "under radar" due to limited or small use. Research for these little-used materials is therefore minor. This is a potential risk to workers that is not studied for substitutes. | |||

CHALLENGE | Hard to predict future restrictions. | |||

CHALLENGE | Difficult to meet compliance so volunteer addressing is extra burden. | |||

Issue #3 Information/disclosure about presence of materials in product (e.g., digital product passport) | ||||

NEED | Reporting of materials details (materials and compounds): Data for product source and location | Reporting of materials details (materials and compounds): Information to help end-of-life processes | ||

CURRENT TECHNOLOGY STATUS | Gaining momentum in consumer products1 | |||

GAP | Component suppliers are removed from the effort so up to manufacturers | |||

CHALLENGE | Critical research materials (CRMs) | |||

CHALLENGE | Scope goes beyond electronics, e.g., other types of non-electronics industries products (textiles) | |||

CHALLENGE | Standards non-existent to be searchable for global environment | |||

CHALLENGE | Protection from disclosure of critical intellectual property | |||

Issue #4 Materials’ selection to support circularity and reduce non-energy greenhouse gas emissions | ||||

NEED | Gas materials (processing materials) contributions to global warming needs to be considered/addressed (e.g., replacement gases, C2F6, sulfur hexafluoride, etc.) | Candidates are discovered and are being researched/proof of concept | New materials are selected and qualified | |

CURRENT TECHNOLOGY STATUS | ||||

GAP | Research funding and high level of difficulty in discovery of better/alternate chemistries | |||

GAP | No regulations compelling industry to act due to small amounts/frequency used in manufacturing | |||

CHALLENGE | No known substitutes for lower global warming potential with comparable processing capabilities | |||

Issue #5 Materials’ selection due to competitions among influential companies vs. the electronics industry. In particular, proactive behavior is needed to match speed of consumer markets. | ||||

NEED | A common, representative voice from the electronics industry to articulate needs before relevant chemical industries | Cross-supply-chain collaboration and alignment (e.g., with oil companies and plastic production; aluminum production) | ||

CURRENT TECHNOLOGY STATUS | ||||

GAP | Restrictions and policy statements not aligned with current situations | |||

CHALLENGE | Economics – electronics is a relatively small market for plastics | |||

CHALLENGE | Pressure from “large” companies within the electronics industry overly influences choices | Pressure from “large” companies influences choices | ||

CHALLENGE | Social pressures | |||

Approaches to address Needs, Gaps and Challenges

Materials Potential Solutions (Table 2) is aligned with Table 1 technology issues. Based on today’s perspectives, the Materials roadmap sub-team lists one or more solutions for each technology issue and grades each solution with a technology readiness level. (The definitions of TRLs can be found at this link: https://inemi-roadmap.scrollhelp.site/ir/technology-readiness-levels-trls .)

In-table color key | Range of Technology Readiness Levels | Description |

|---|---|---|

2 | TRL: 1 to 4 | Levels involving research |

6 | TRL: 5 to 7 | Levels involving development |

9 | TRL: 8 to 9 | Levels involving deployment |

Table 2. Materials Potential Solutions

|

| EXPECTED TRL LEVEL* | |||

TECHNOLOGY ISSUE | POTENTIAL SOLUTIONS | (2023) | 3 (2026) | 5 (2028) | 10 |

Issue #1 Restriction of PFAS substances in the EU (entire ecosystem) | PFAS-compliant alternative materials (e.g. substitutes for Teflon) | 4 | 6 | 9 | 9 |

Obtain long-term exemptions for PFAS materials critical to the industry but have no ready substitutes (e.g. fluoropolymers for applications needing their mechanical, electrical stability) | 9 | 9 | 9 | 9 | |

Issue #2 Proactive future material and substances substitution | Identify existing or establish new (regional/national) industry associations/initiatives for a collaborative forum for the electronics industry with regulators, suppliers, etc. [Example: European IT Certification Academy/ Environmental Impact Assessment/ Japan Green Procurement Survey Standardization Initiative (EICTA/ EIA/ JGPSSI) collaboration led to IEC 624742, on substance content reporting in the supply chain] | 3 | 7 | 8 | 9 |

… for a collaborative forum with environmental scientists/toxicologists who monitor environmental issues, etc. | 3 | 7 | 8 | 9 | |

Issue #3 Information/disclosure about presence of materials in product (e.g., digital product passport) | Extension of the digital product passport solution up the supply chains to components and materials (with a focus on electronics industry) | 6 | 7 | 8 | 9 |

Data protection via complex controls and per-use filtering. | 9 | 9 | 9 | 9 | |

Issue #4 Materials’ selection to support circularity and reduce non-energy greenhouse gas emissions | New materials and chemistries, followed by process updates | 2 | 4 | 6 | 8 |

Materials with a lack of environment-profile data publicly available: beryllium and some other minor metals | 7 | 7 | 9 | 9 | |

Issue #5 Materials’ selection due to competitions among influential companies vs. small | One or two of the existing industry associations to take the lead in developing a single voice for the electronics industry within other for a where decisions are made. [Example: In the development of new easily recyclable plastics within the petrochemical industry.] | 6 | 7 | 8 | 9 |

Technical maturity of various approaches to recycling and reuse of different materials is considered in the links for Tables 2 and 3 that comprise the Materials Tables. These tables list the TRLs for each material for various recycling technologies, as well the major sustainability issues, ranging from toxicology to material availability. An illustration of these as an image is a link to the Materials Table page and the files of the two tables.

Table 3 Elemental materials used in electronics, their sustainability issues, and technology readiness of the appropriate recycling and reuse technologies.

Table 4. Compound materials used in PCBs and their manufacture, the associated sustainability issues, and technology readiness of the appropriate recycling and reuse technologies.

Conclusions

From a material perspective, sustainable electronics means higher material efficiency while utilizing materials with lower environmental impacts and human health risks. It is critical that the entire product life cycle is considered to avoid potential pitfalls. The roadmapping effort has identified the following key issues:

Material substitution is predicted to continue for the electronics industry as the negative environmental impact of the use of materials are understood better. As part of a proactive response, the industry needs to come together to create a consensus viewpoint for the industry. However, in this point in time, the industry is in a reactive mode to the development of regulation, which may lead to less effective and less efficient solutions. Industry needs to drive the development and characterization of new materials and processes that will support appropriate material substitution.

Disparities in legislation and regulation could create fragmented markets. Industry wishes to see reduced disparities between different regions and even states’ regulations. Ideally, regional and federal efforts should be ahead of state-level regulation. However, alignment will be limited by the practical needs of a given state, country or multi-national region.

To be proactive, the electronics industry needs to understand better what materials it is using and their eco-impact. In addition, a full environmental and human health assessment is highly recommended when considering introducing new classes of materials. Collaboration with material science experts and regulating parties and toxicologists is critically needed.

The extent of regulation and its enforcement sometimes depends on the size of the companies involved: smaller companies often have exceptions. The challenge for industry is to find ways to close this gap without pushing subject matter experts (SMEs) out of business.

As digitalization continues, opportunities have emerged to enhance sustainability through improved supply-chain visibility. The concept of a digital product passport is a good example of the current trends. With the proper documentation of products, components and their composition from a sustainability perspective, many barriers faced by reuse, remanufacturing, and recycling can be effectively removed thus promoting circularity.

Sustainability will be a key part in the material supply chain. Although this has already been done to a certain extent at an individual company level, the industry as a whole needs to collaborate in supporting correct, sustainable supply chains. One example of the industry working together is that of the industry response to responsible sourcing of conflict minerals, where the solution was for proper tracing in collaboration with the smelters, enforced using global audits.

Acronyms Table

References

IEC 62474. https://std.iec.ch/iec62474

Ministry of Commerce and the General Administration, China, “Announcement No. 23 [2023] of the Ministry of Commerce and the General Administration of Customs Announcement on the Implementation of Export Control on Items Related to Gallium and Germanium,” http://www.mofcom.gov.cn/article/zwgk/gkzcfb/202307/20230703419666.shtml , 2023.

IMEC, “The green transition of the IC industry”, white paper, 2022.